Roth ira calculator vanguard

The assets are transferred into an Inherited Roth IRA held in your name. Coverdell Education Savings Account - ESA.

The Optometrist S Guide To Roth Ira Chapter 2 Step By Step Vanguard Ods On Finance

This basic robo-advisor builds portfolios from Vanguard ETFs which charge among the lowest expense.

. Decide Where to Open Your Roth IRA Account. Roth IRAs are a popular way for people to save for retirement. You fund a Roth IRA with money youve already paid income taxes on.

When Roth IRA Funds Are Taxed. A Coverdell Education Savings Account is a tax-deferred trust account created by the US. Instead of letting you defer taxes until you make withdrawals with a Roth IRA you pay taxes as normal on amounts being contributed and can later withdraw money from the account tax-free during retirement.

You can withdraw your Roth IRA contributions without paying taxes or a penalty at any time. They offer roughly the opposite tax benefits of traditional IRAs. For the 10-year period ended December 31 2021 7 of 7 Vanguard money market funds 67 of 86 Vanguard bond funds 21 of 24 Vanguard balanced funds and 128 of 183 Vanguard stock fundsfor a total of 223 of 300 Vanguard fundsoutperformed their Lipper peer group averages.

Roth IRA owners dont. Roth IRAs RMDs. If you have an existing traditional IRA the same company can probably open a Roth IRA for you.

If the 10-year rule is being used for your inherited account you should consult your tax advisor if you have any questions about taking distributions in accordance with this rule. Vanguard Digital Advisoroffers a simple inexpensive platform for automated IRA management. Traditional IRA calculator and other 401k calculators to help consumers determine the best option for retirement savings.

As long as you wait until youre 59 ½ and youve held the account for at least five years your gains are tax free. Almost all investment companies offer Roth IRA accounts. Government to assist families in funding educational expenses.

Money is available At any time up until 1231 of the tenth year after the year in which the account holder died at which point all assets need to be fully distributed. As an investor-owner you own the funds that own Vanguard. Vanguards RMD Service doesnt accommodate accounts that are being distributed according to the 5 or 10-year rules.

Vanguard Debit Card In 2022

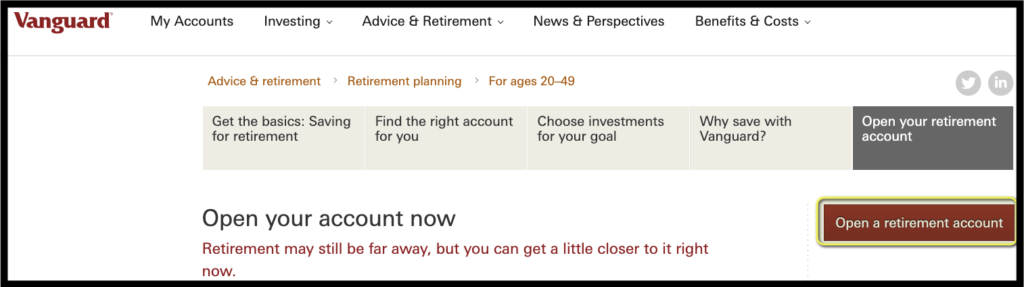

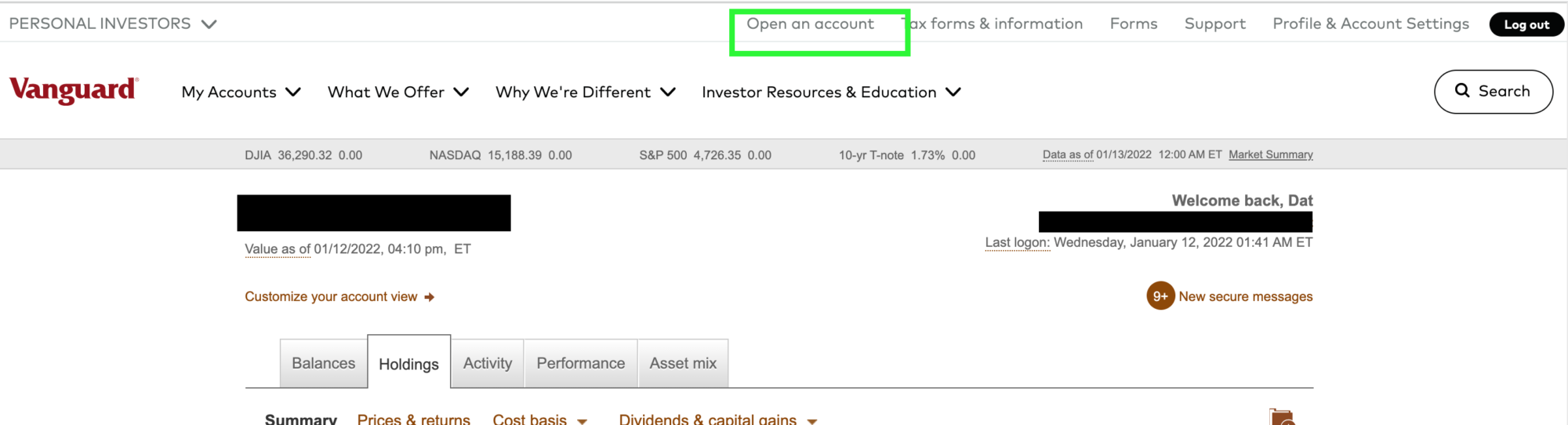

How To Open A Roth Ira With Vanguard In 8 Easy Steps

The Optometrist S Guide To Roth Ira Chapter 2 Step By Step Vanguard Ods On Finance

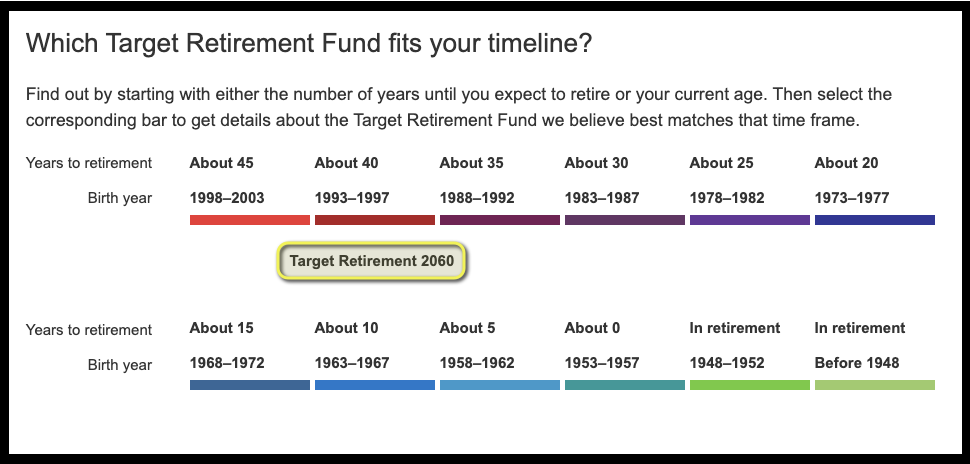

Vanguard How To Open A Roth Ira And Start Investing Asap Ready To Roth

The Optometrist S Guide To Roth Ira Chapter 2 Step By Step Vanguard Ods On Finance

How To Open A Roth Ira With Vanguard In 8 Easy Steps

Vanguard How To Open A Roth Ira And Start Investing Asap Ready To Roth

Vanguard Consider The Advantages Of Roth After Tax Contributions

The Optometrist S Guide To Roth Ira Chapter 2 Step By Step Vanguard Ods On Finance

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Quick And Easy Retirement Calculator Fpw

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

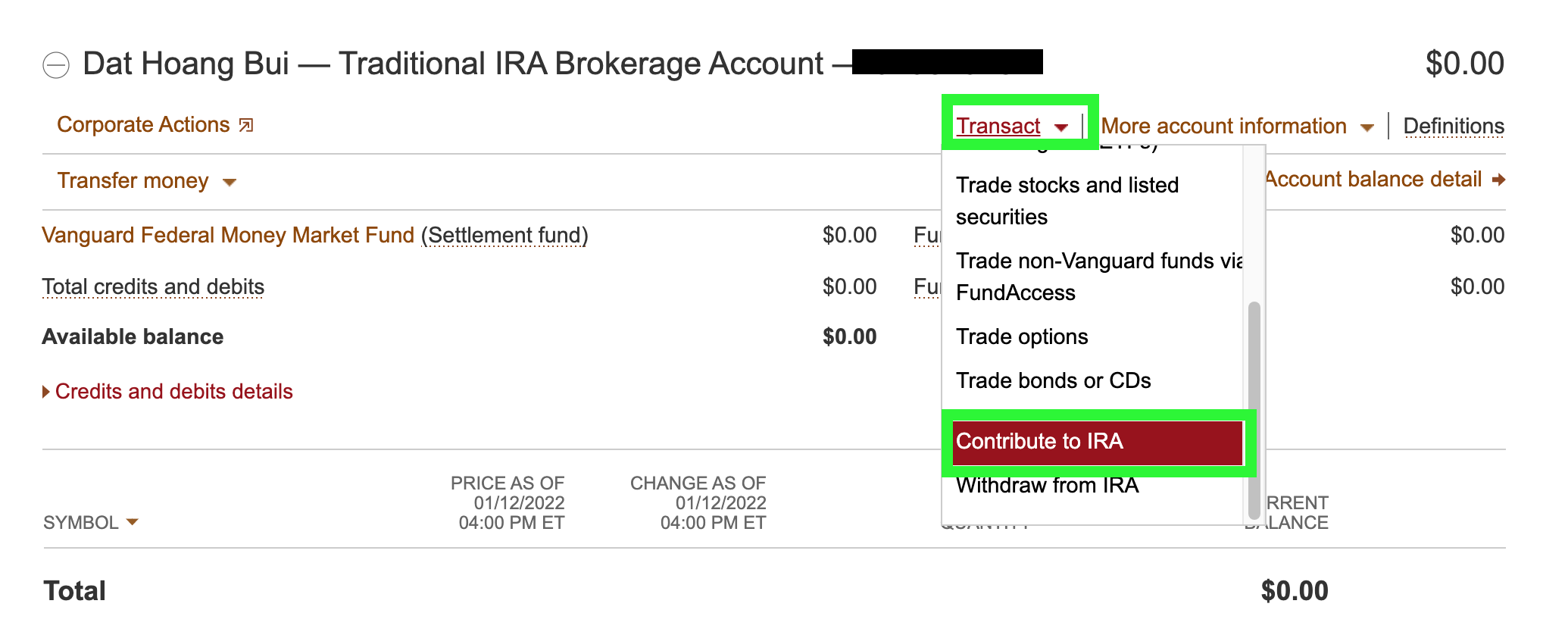

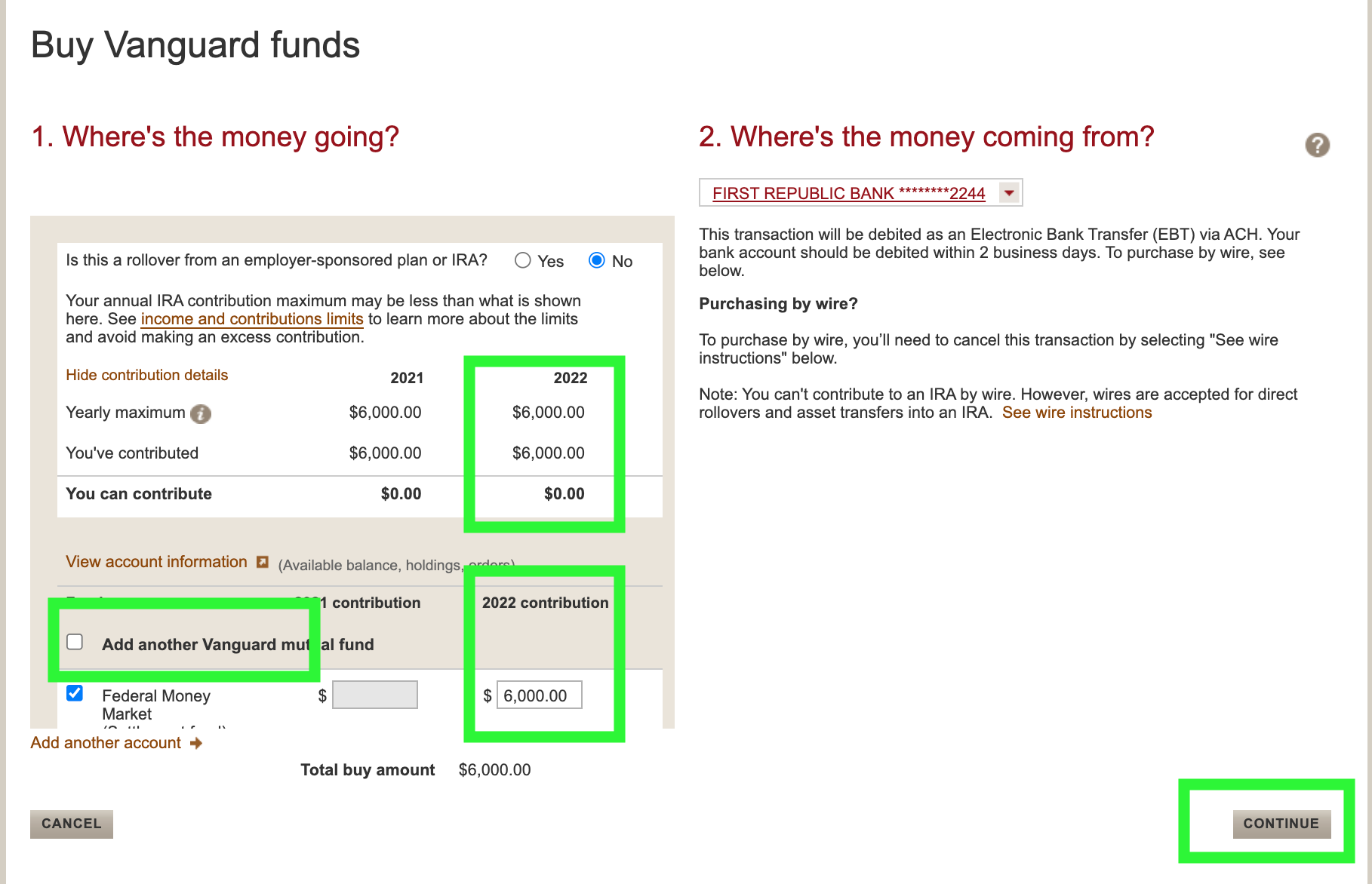

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth

The 10 Best Retirement Calculators Newretirement

Retirement Expenses Worksheet Vanguard